Hiring teams want their job posts to be as attractive as possible to potential candidates. That’s true in normal times when there are plenty of job seekers, and it’s truer during a tight labor market when there are fewer job seekers. But that doesn’t mean you should turn to job title inflation, which causes more harm than good.

Job title inflation is the practice of leveling up a job title without leveling up the associated responsibilities and requirements along with it. For instance, adding ‘Senior’ to a ‘Software Engineer’ job that only has mid-level or junior requirements. Title inflation is often a well-meaning attempt to add value to a job so it can attract a larger applicant pool.

However, more often than not title inflation has a detrimental impact on candidate pools. Seemingly inflated titles that don’t fit the requirements can intimidate or confuse otherwise qualified candidates – or prevent them from finding jobs on search engines entirely. Subsequently, hiring teams may inadvertently attract unqualified applicants.

Yes, it’s a tight labor market

We’ve been collecting and analyzing real-world job descriptions and hiring outcomes for years. We like to analyze and share our data, and we did that recently with tech hiring. By analyzing job listing data from over 10,000 companies, we were able to find some interesting tech recruiting trends. They include loosening certain job requirements, such as education requirements.

Long story short, the labor market tightness is in no way your imagination. Applicant pools for tech jobs, for example, have gotten significantly smaller in the last couple years. They attracted around 120 applicants in 2019 but only 77 in 2021.

One of the reasons for the decrease in applicant pool size is a rise in the number of jobs on offer. Companies advertised over 80% more tech jobs in 2021 than they did in 2019, in large part because of a surge in funding and large valuations. (Tech hiring stalled briefly during the pandemic but roared back in a way that hiring for most industries did not.)

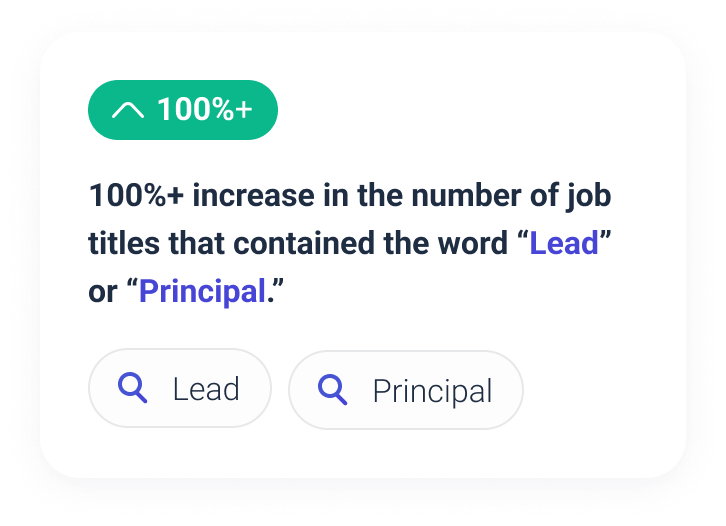

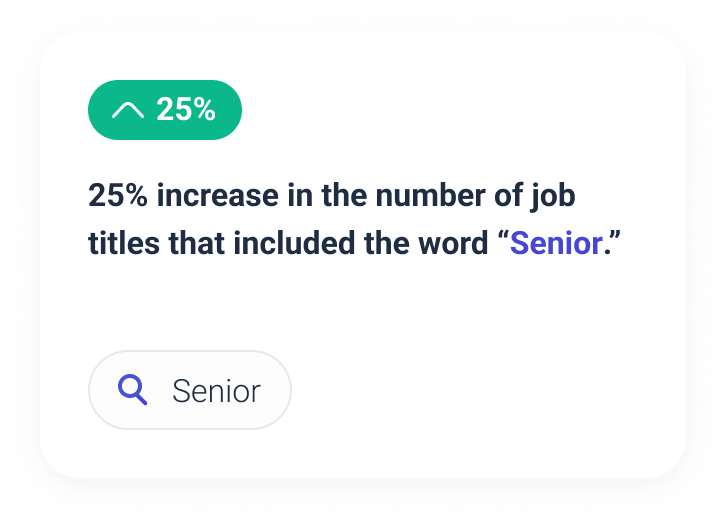

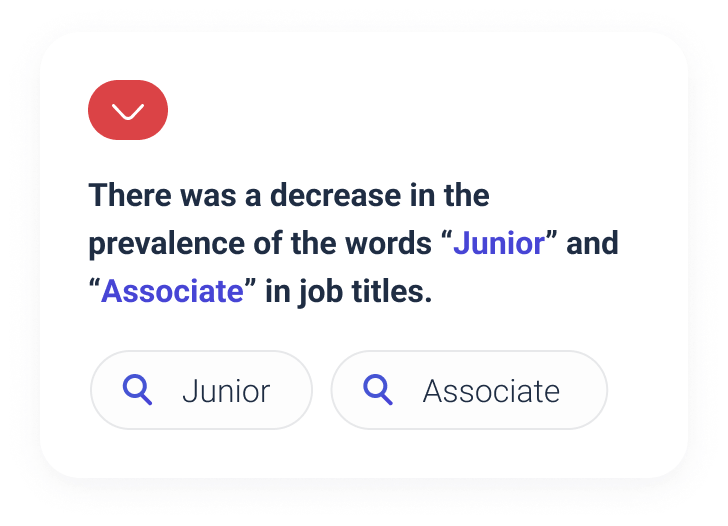

One tactic that companies have been turning to during the tight labor market is job title inflation. According to our data, a quarter of the tech jobs considered junior in 2019 now carry senior titles. (Typically, we think of junior jobs as requiring less than four years of experience, mid-level as requiring four to 10, and senior as requiring 10 or more.) Also, twice as many junior jobs today include the word ‘Lead,’ and 20% more mid-level jobs include the word ‘Senior.’

But job title inflation can mean weaker applicant pools

For a while now, we’ve been getting questions from some of our U.S. customers about financial analyst titles. We’ve gotten enough questions that we analyzed our data to see whether industry norms have changed.

Looking at current and historic trends in job posts, we found that titling has indeed changed for financial analyst titles. Over half of all junior financial analyst titles (i.e., requiring less than four years of experience) now include the word ‘Senior.’ Meanwhile, less than 1% of senior financial analyst roles that include the word ‘Senior’ in the title now require more than eight years of experience. Typically, we would expect senior jobs to require over 10 years of experience.

This matters for a couple of reasons. One, because ‘Senior’ in a job title can deter any job seeker who doesn’t view themselves as ‘senior,’ regardless of the requirements listed. Two, because actual financial analyst job seekers don’t necessarily love the word ‘Senior’ in a job title. We looked at our data and found that jobs with ‘Senior’ in the title attract on average:

- 29% fewer applicants,

- 39% fewer qualified applicants, and

- 27% fewer female applicants.

Although tempting in a tight labor market, avoid job title inflation

Potential candidates use the job title to determine whether they qualify. If the title doesn’t match the requirements, that can be a big deterrent for qualified job seekers.

Mostly, the trend seems to go in the direction of a senior title with junior- or mid-level requirements, but it can go the other way too. If the requirements and responsibilities seem senior but the title is junior, that could also deter an otherwise qualified job seeker.

It’s important to remember that a job post is, at its core, a message from a company to a job seeker. Possibly the only message from your company that someone sees, as a matter of fact.

If the message is clear (and inclusive), it’s easier for job seekers to understand whether they qualify ─ both job seekers who are qualified and also those who are not. Meaning you’ll likely notice more qualified applicants and fewer unqualified applicants in your pipelines.

Bottom line, it’s tempting in a tight labor market to try anything to attract applicants. But job title inflation does more harm than good. To your potential candidates, to your applicant pipelines, and to your hiring efforts overall.