You may hear about unemployment rates all the time, but labor market tightness is also a key metric for recruiting teams to pay attention to. The ratio of job seekers to open jobs has a direct impact on how hard you have to compete for candidates. Yet without knowing the current dynamic and the level of competition you’re likely to face, you can’t set expectations for the hiring process.

We’ve been hearing a lot lately about recruiting challenges that seem to stem from labor market tightness. Despite the countless recent headlines surrounding layoffs (largely tech industry-focused), nearly all the talent acquisition teams we work with across different industries say that hiring has been particularly hard in the last couple years, during the pandemic but also continuing after it ended. So we decided to look at the data.

US labor market tightness by the numbers

The U.S. Bureau of Labor Statistics regularly publishes data collected as part of the Job Openings and Labor Turnover Survey (JOLTS) program, which contains data on job openings, hires, and separations in a given period.

Datapeople uses this raw data to calculate labor market tightness by comparing the number of job seekers to the number of job vacancies. (Not a calculation you’ll find in the government data.) When the ratio of job seekers to job vacancies is below 1, it indicates labor market tightness because it means there are more jobs available than people looking for jobs.

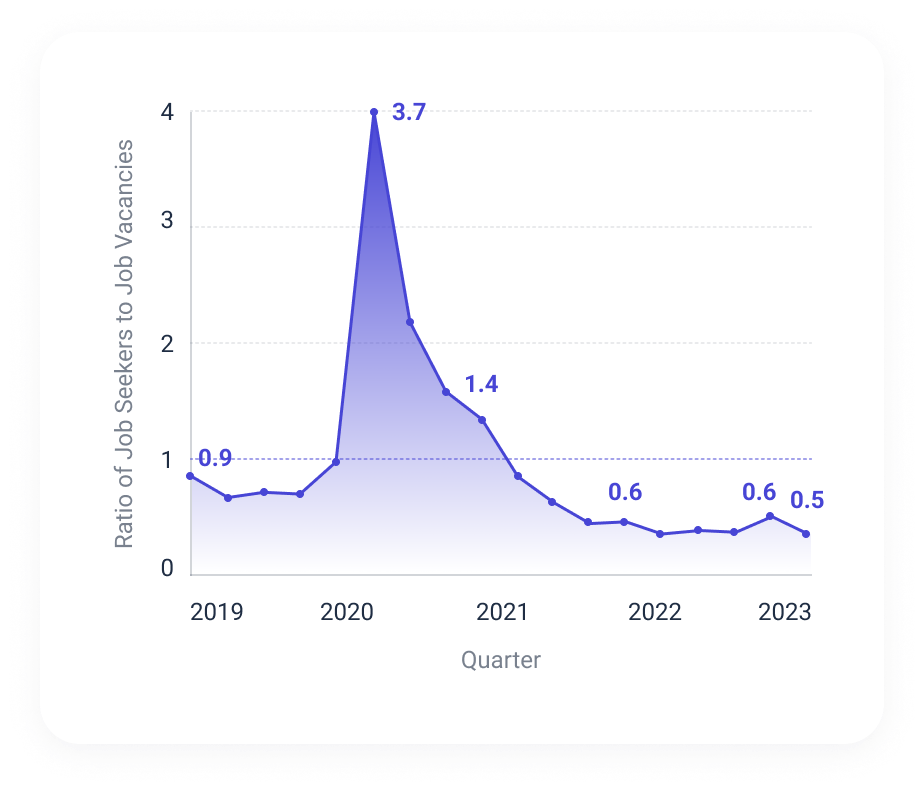

The graph below demonstrates that in the past year the labor market has constricted more than 7x the saturation seen during the peak of the pandemic. Although behavior during the pandemic period was certainly abnormal, recent quarters demonstrate a “holding pattern” of nearly twice as many job vacancies to job seekers.

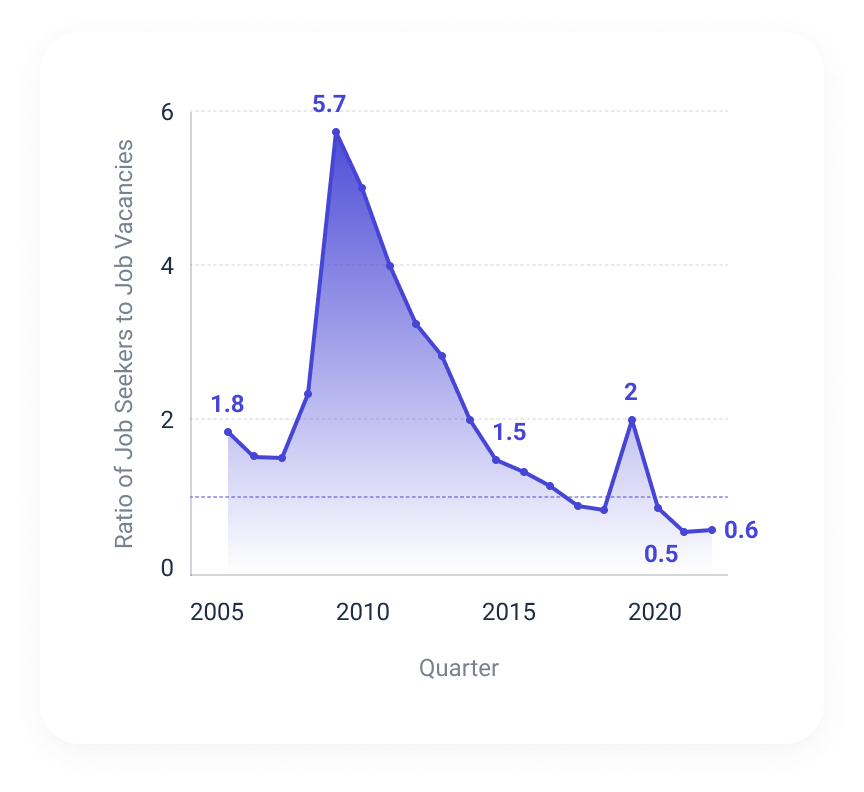

For historical context, consider yearly averages since 2005. The spike in the ratio of seekers to vacancies during 2020 is actually more aligned with historical ratios than those in recent years. This illustrates that the current labor market tightness is unprecedented territory for most of us in our careers.

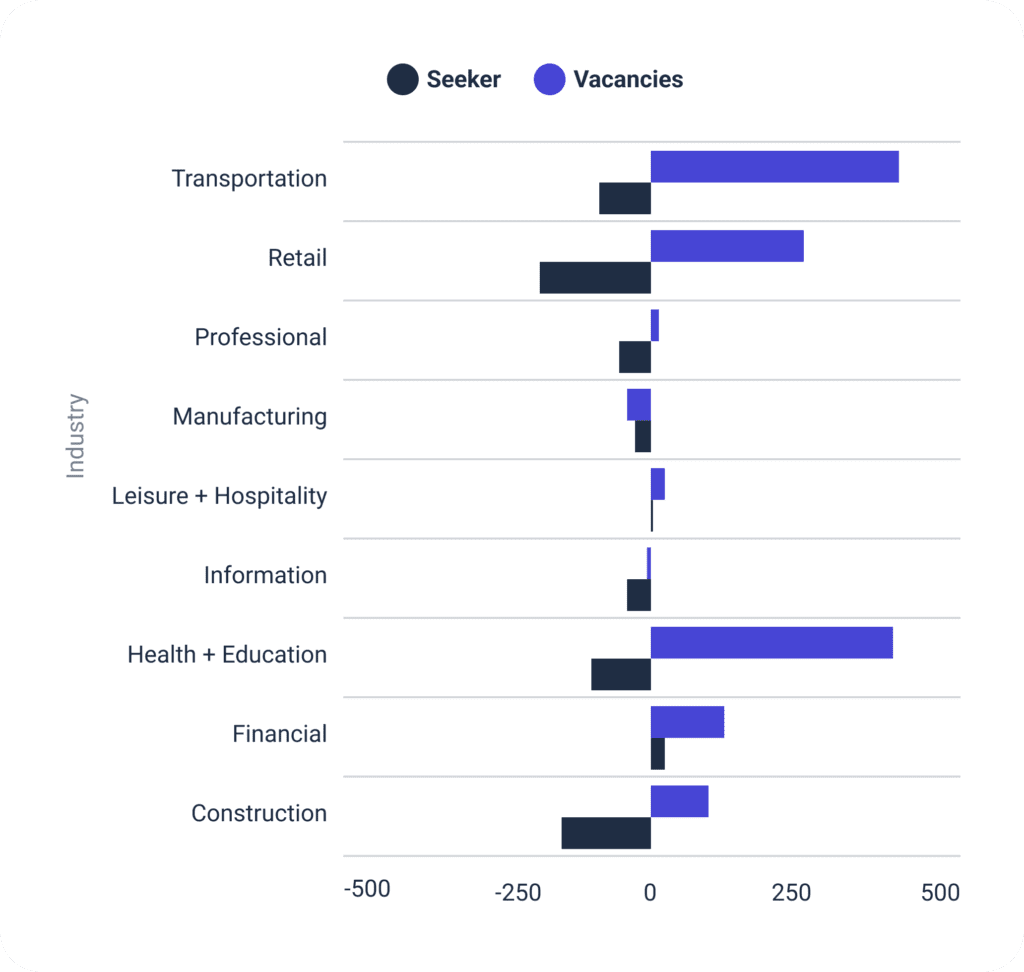

We also see that recent job seeker and vacancy estimates vary by industry. In particular, transportation, health + education, and construction companies saw a particularly large disparity between the change in job seekers and vacancies.

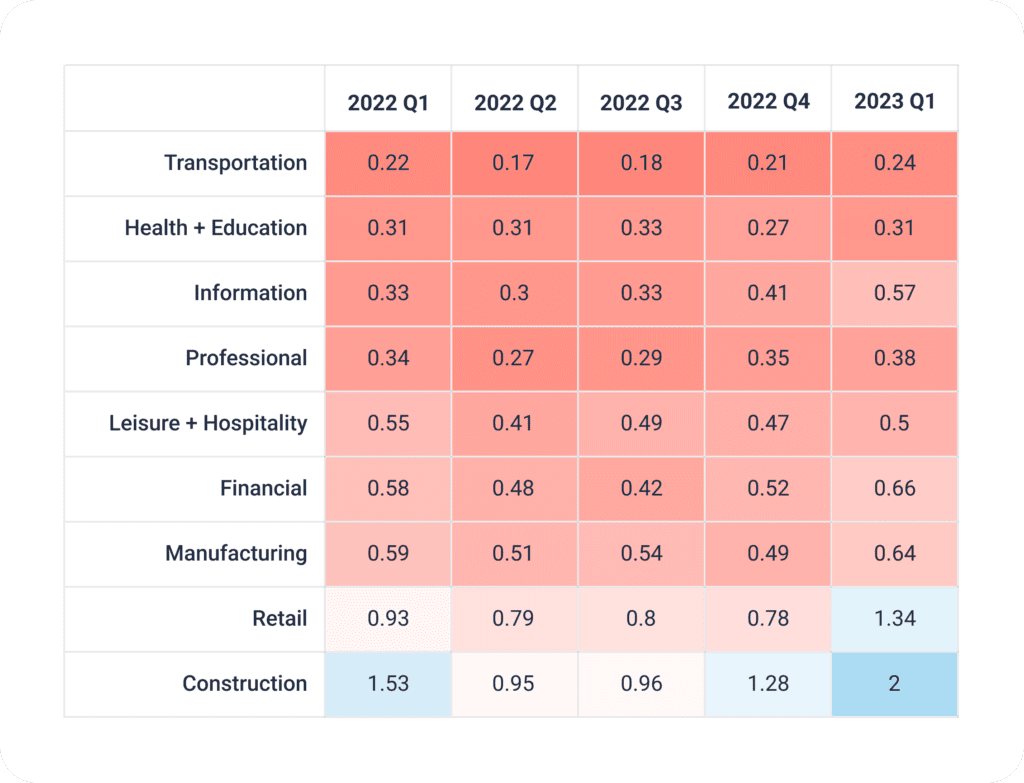

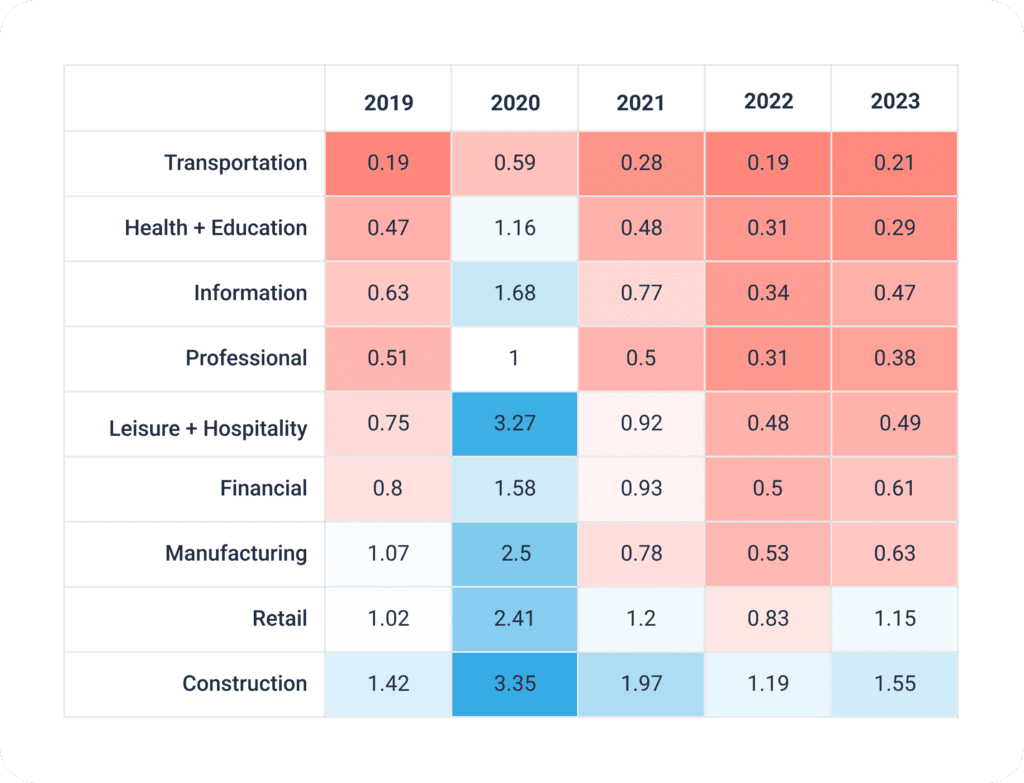

The heat map below illustrates seeker-to-vacancy ratios by industry, where values closer to 1 (an equalized market) are blue and values closer to 0 (a tight market) are red.

Transportation, health + education, and professional sectors generally face continued labor market tightness. In these roles, there are about three or four jobs for each job seeker. Construction and retail sectors have seen a more relaxed labor market during recent quarters. In these roles, there are now about one or two job seekers for each job.

Historically speaking, several industries have experienced the pivotal moment of job-seeker-to-vacancy ratio dropping below an equalized ratio (i.e., 1) in the past five years. The manufacturing and leisure + hospitality sectors have experienced unusually high labor market tightness in the past two years relative to previous ones.

Pay attention to labor market tightness too

Talent acquisition teams have noticed the tight labor market, with good reason. The historical trend data support the narrative that hiring has been especially hard recently. It was particularly true in 2022 across all sectors, although we may be seeing a rebalance in the first quarter of 2023.

It’s not good news, but it’s helpful news. Knowing when you’re in a tight market helps you gauge how competitive hiring will be. You can use that information to tweak your jobs as needed (e.g., higher pay, additional perks, or other incentives) or adjust your hiring process overall (e.g., fewer, faster interview rounds). (We do not recommend job title inflation as one of those tweaks, by the way.)

Unemployment numbers are important, sure, but they aren’t the only numbers to keep an eye on. The ratio of job seekers to available jobs in your industry has a direct impact on how difficult it is to attract and hire qualified candidates. And while there’s nothing you can do to change the market, there’s plenty you can do to make your jobs, process, and talent strategy more competitive.