To gauge ROI on applicant sourcing channels, you have to be able to track where each applicant comes from and how far they get in your hiring process. Applicant tracking systems (ATSs) offer some data on candidate sources, but they’re often so customized or overwhelming that they don’t cough up meaningful insights very easily.

Operating without reliable applicant sourcing data leaves you flying blind, and spending hours (or days) in spreadsheets trying to make sense of your ATS data is time you could be spending on more value-added work.

The problem: Unclear applicant sourcing channel ROI

While ATSs do many things, they don’t intelligently aggregate applicant sourcing data to help you gauge ROI on sourcing channels. Not without hours of manual effort, anyway.

Part of it is the way ATSs organize data (i.e., how they tie together or don’t tie together job reqs, job postings, applicants, and hires). Part of it is how they read data in open text fields (e.g., ATSs don’t know “LI” is the same as “LinkedIn,” so comparisons are hard and consistent naming conventions are absolutely vital). And part of it is the limited timeframe they address (e.g., they only capture candidate activity after the job post is live and nothing before).

In short, ATSs don’t make it easy to get reliable applicant sourcing data. Yet that data is vital to understanding your inbound and outbound pipelines and appropriately allocating spend and energy among your sourcing channels.

Inbound recruiting (when candidates actively seek out and apply to your jobs) is more fair and efficient than outbound (when you actively seek them out). Inbound isn’t exclusionary like referrals, doesn’t require manual prospecting, and isn’t usually expensive (if it costs anything). And it casts the widest net possible, giving all qualified job seekers the opportunity to apply and, subsequently, attracting large, qualified, and diverse applicant pools.

However, many companies leverage outbound tactics alongside inbound. Some do it because they’re struggling with inbound. Others do it because they believe candidates referred by current employees or premier search firms are more qualified than inbound candidates. (There’s hardly research to support this, though, and according to our data on efficient recruiting processes, outbound candidates drop out of the hiring process at twice the rate of inbound candidates.)

Regardless, when applicant sourcing data is dirty, inaccessible, or nonexistent, it can’t inform these strategies. And the trick with inbound and outbound recruiting is using data to balance them appropriately.

How unclear applicant sourcing data can impact you:

Depending on your organization’s size and hiring goals, outbound recruiting can cost over six figures. From contracting with agencies to messaging passive candidates on LinkedIn, it all costs money. It’s vital to ensure your money is well spent.

Some outbound sources are subscription-based software services (e.g., LinkedIn Recruiter and Gem) that require annual payment regardless of how they perform. (This is why it’s crucial for you to measure how many qualified candidates and hires those services drive.) Meanwhile, agency and referral fees are expensive but not necessarily wasteful because you only pay when you make a hire.

The main question is how you use agencies, employee referrals, dedicated sourcers, and the like. Are you using them intentionally for critical roles you struggle with or that are experiencing a tight labor market? Are you using them because of potentially biased beliefs (e.g., referrals are better than cold applicants)? Or are you using them because other steps in your hiring process are broken? (Our research shows that a whopping 31% of jobs are no-hire requisitions that don’t result in a hire. Misaligned hiring teams and poorly calibrated job posts are likely culprits.)

This is where you should apply scrutiny and ask whether you truly need prospecting, subscriptions, and “x number of seats.”

The solution: Datapeople Insights Inbound, Outbound, and Overall Reports

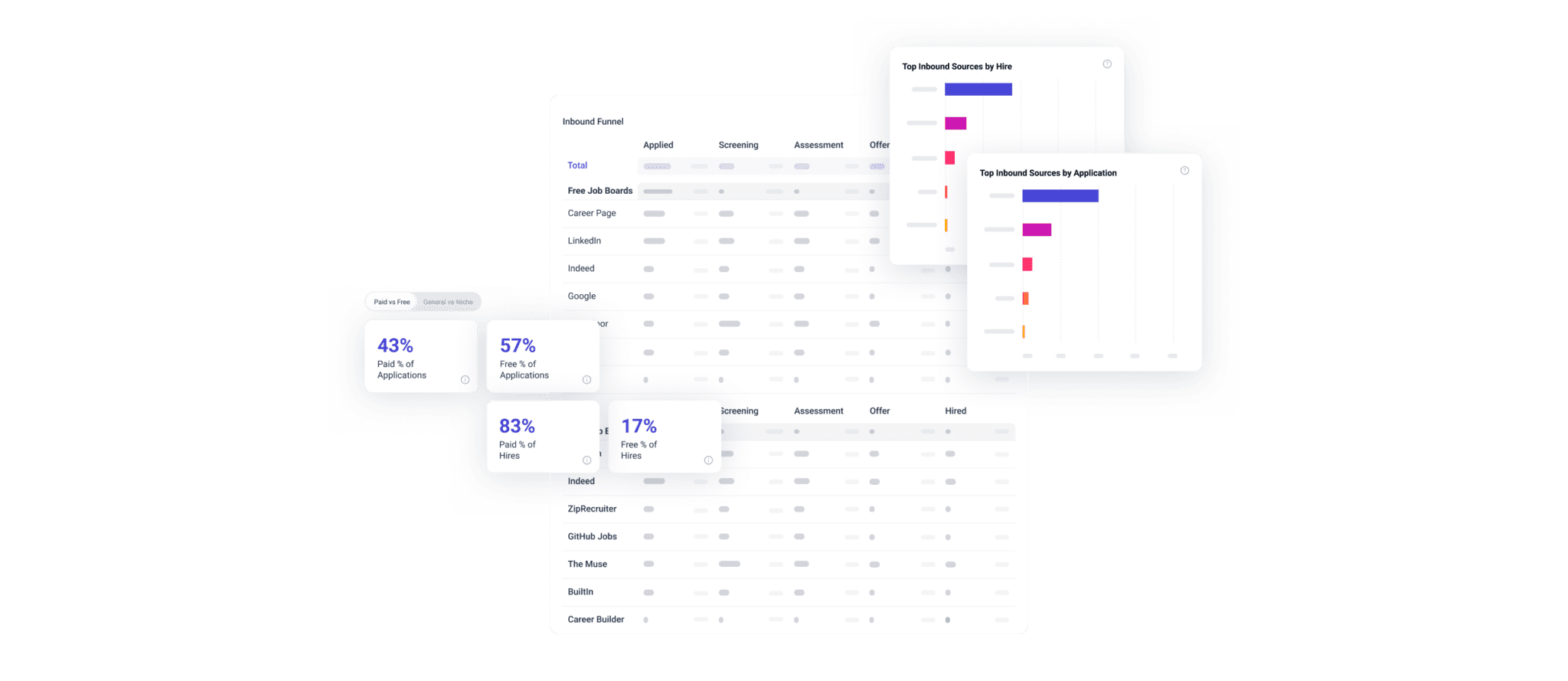

Using our Inbound and Outbound Reports in tandem with our Overall Report helps you allocate your resources more strategically (vital during times of labor market tightness). With a clear view of sourcing channel ROI, you can leverage high-performing inbound sources whenever possible and focus outbound resources on more challenging reqs.

Our Inbound Report organizes all of your ATS data and instantly identifies your most and least effective inbound channels so you can double down on the ones that are working. By maximizing your inbound channels, you can save time and money while also attracting more qualified, diverse applicant pools.

Similarly, our Outbound Report pinpoints your highest- and lowest-performing outbound channels. Considering how much time and budget these tactics require, it’s vital that you know which are attracting qualified applicants and hires – and that you stop spending on those that aren’t.

Yet a heavy reliance on outbound channels may signal an inefficient or unfair hiring process, even if you’ve optimized for the most cost-effective outbound sources. (It may also result in a less diverse candidate pipeline, which is something you can measure with our Gender Report). Our Overall Report alerts you to any imbalance between your inbound and outbound channels that may be worth investigating – particularly if you have far more outbound hires than candidates.

Questions you can confidently answer with the Inbound, Outbound, and Overall Reports:

- Which inbound sources result in the most applicants and hires?

- How are my sponsored job ads performing relative to free job ads?

- Which sources did most of our outbound hires come from last quarter?

- Are our prospecting efforts resulting in applicants? Hires?

- Which outbound sources resulted in the fewest applicants and hires?

- How does source performance vary across departments and locations?

…and more.

How those insights help you:

- Allocate resources more strategically: Easily identify your best- and worst-performing applicant sourcing channels so you can focus your efforts accordingly.

- Reduce time to fill: Direct your spend and energy toward channels that bring in qualified applicants more quickly.

- Reduce cost per hire: Pull spend and recruiter capacity from expensive, time-consuming channels that aren’t working.

- Increase diversity: Maximize your inbound channels to attract larger, more qualified, and more diverse applicant pools.

Datapeople Insights

With Datapeople Insights, we take the leg work out of recruiting data analysis so you can spend your time doing meaningful work, not manual work. Request a demo to get one step closer to more fair, efficient, and successful hiring outcomes.